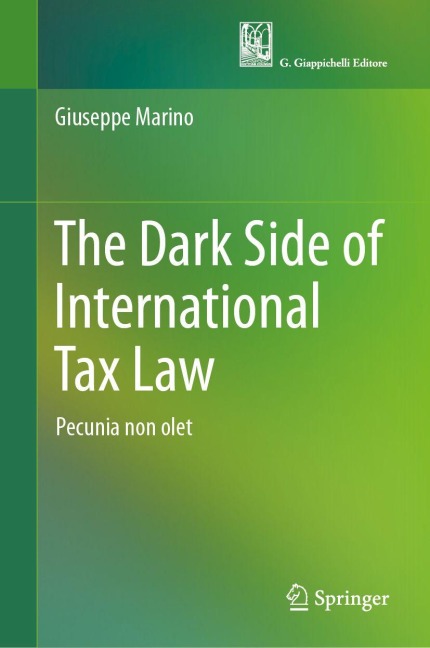

There is always a dark side, and taxation in its international dimension is no less. Pecunia, being the cash, drives it more than philosophical principles like justice or solidarity. International taxpayers, whether individuals or corporations, do not feel the same obligations vis à vis the society where they temporarily live, work and produce their wealth as if they would feel if they were permanently integrated in a country. The reader of this textbook will be conducted within the technicalities of international taxation by way of an original perspective on philosophy, politics and economics (PPE) affording (i) who has the right to exercise the power to tax by examining the criteria to determine the jurisdiction to tax both in the worldwide and territorial system, (ii) how to exercise the power to tax, through tax return or withholding tax, (iii) what to tax among active and passive income within inbound and outbound taxation, (iv) how much to tax through the transfer pricing, (v) international taxation as part of international law, (vi) international tax treaties, and finally (vii) the BEPS projects that represent the very last evolution in the field. Scandals, leaks as a James Bond movie, aggressive tax planning techniques and related case law, involving high-net-worth individuals as well as multinational corporations, bring the reader to discover that each single State belonging to the international community acts as a chess player before the international tax chessboard observing as pieces its own economy, its own society, and balancing any tax policy decision with possible reactions of domestic taxpayers that could move away, those foreign taxpayers that could decide to move in, and possible retaliations from other States.

The ambition is to get the reader convinced that, as the Sicilian Tancredi Falconeri warns his uncle Don Fabrizio Corbera, Prince of Salina, in the masterpiece book “The Leopard” of Giuseppe Tomasi di Lampedusa, “everything must change because everything remains as it is”, and only exploring what is behind the stage of international taxation clarifies how this important piece of social science really works.

Giuseppe Marino (Naples 1965) lives in Milan with the Family. He graduated in Business Administration at Bocconi University (1988) and in Law at the University of Milan (1992). Ph.D. in International and Comparative Tax Law at the University of Genoa. Research Associate of International and Comparative Tax Law, at the International Bureau of Fiscal Documentation (IBFD), in Amsterdam. Full Professor of Tax Law at the Faculty of Law of the University of Milan where he teaches Theory and Practice of International Tax Law (www.unimi.it/it/ugov/person/giuseppe-marino). During his academic career he has been visiting professor of Tax Law at the New York University School of Law, at the University of Paris, Panthéon Sorbonne, at the Meiji University of Tokyo, at the Lomonosov Moscow State University, at the University of St. Gallen, at Bocconi University of Milan, and at the Singapore Management University. He has also been Director of the Master Program in Business Tax Law, at Bocconi University, Member of the Scientific Committee of the European Association of Tax Law Professors (EATLP) and Member of the Consultative Commission for the Exchange of Information and Tax Cooperation, Principate of Monaco. In 2015 he was EATLP General Reporter for the research "New Exchange of Information Versus Tax Solutions of Equivalent Effect". He currently is: (i) Member of the Taxation and Fiscal Policy Committee of the Business Industry Advisory Council (BIAC), at the OECD, Paris; (ii) Director of the Post Graduate Program in Corporate Tax Governance at the University of Milan, (iii) Member of the Consultative Commission for the Italian Tax Reform, (iv) Director of Diritto e Pratica Internazionale and Rivista di Diritto Tributario Internazionale. Giuseppe Marino is a lawyer and CPA, founding partner of the Tax Law Firm Marino Ballancin e Associati, in Milan (www.mba-tax.it), he practices as tax litigator for MNEs and advises corporations on international tax governance topics.

Und dann auf "Zum Home-Bildschirm [+]".

Und dann auf "Zum Home-Bildschirm [+]".