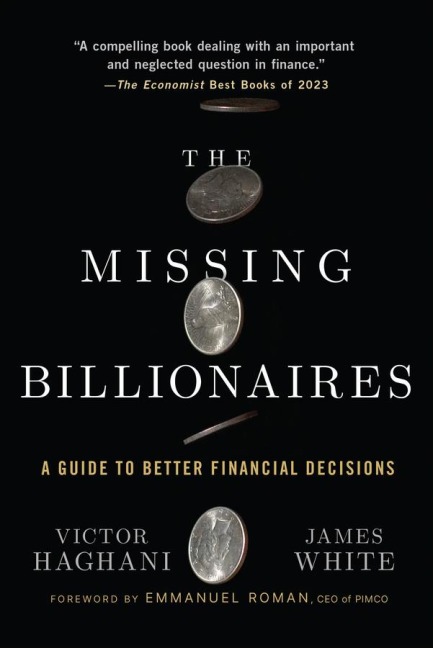

Praise for THE MISSING BILLIONAIRES "Making Money and Keeping It" -The Wall Street Journal "No matter the size of your net worth, keen insights for everyone on the difference between getting rich and staying rich." -Morgan Housel, Author of The Psychology of Money "How much investment risk should I take? How much should I spend, and how much should I save? We all want answers to these questions, and financial economists have them, but the answers need to be translated into practical language. That's exactly why you should read this enjoyable and insightful book, to understand and apply the best thinking about risk-taking and lifetime financial planning." -John Y. Campbell, Morton L. and Carole S. Olshan Professor of Economics at Harvard University "If wealthy Americans in 1900 had followed modern optimal investment and spending policies, they could have had 16,000 billionaire descendants by 2025. Instead, the total of all billionaires is about 1,000, which implies they did not. This book is a guide for doing better." -Edward O. Thorp, mathematician, hedge fund manager, legendary gambler, author of Beat the Dealer "This book is a great education for all of us, seamlessly marrying sophisticated theory with applications, demonstrating the beauty of a risk architecture that combines specificity with illuminating implementations into the lifetime wealth management problem." -Myron S. Scholes, Frank E. Buck Professor of Finance, Emeritus, Stanford Graduate School of Business, Nobel Laureate in Economic Sciences "Real world financial decision-making is more akin to poker than chess, with uncertainty playing a central role in every hand. But unlike the zero-sum poker table, everyone can be better off by making well-reasoned personal financial choices. The Missing Billionaires provides the theory and practical tools you'll need to make your own financial decisions sensibly and confidently." -Annie Duke, Decision science expert, poker champion, author of Thinking in Bets, How to Decide, and Quit "The Missing Billionaires addresses a topic that gets far too little attention in the investment community: how much to invest. The book is a terrific blend of theory, practice, and stories from the front lines. This is must-reading for anyone seeking to invest and spend wisely." -Michael Mauboussin, Author and Head of Consilient Research, Morgan Stanley

Victor Haghani has 40 years' experience working and innovating in the financial markets, and has been a prolific contributor to academic and practitioner finance literature. He founded Elm Wealth in 2011 to help clients, including his own family, manage and preserve their wealth with a thoughtful, research-based, and cost-effective approach that covers not just investment management but also broader decisions about wealth and finances. Victor started his career at Salomon Brothers in 1984, where he became a Managing Director in the bond-arbitrage group, and in 1993 he was a co-founding partner of Long-Term Capital Management. He lives in London and Jackson Hole, Wyoming. James White has spent two decades working in finance, covering the gamut of quantitative research, market-making, investing, and wealth management. He is currently the CEO of Elm Wealth, and previously has held research, trading, and executive roles at PAC Partners, Citadel, and Bank of America. He lives in Philadelphia.

Foreword xiii Preface xvii About the Authorsxxi Acknowledgments xxiii Chapter 1: Introduction: The Puzzle of the Missing Billionaires 1 Section I: Investment Sizing 13 Chapter 2: Befuddled Betting on a Biased Coin 15 Chapter 3: Size Matters When It's for Real 27 Chapter 4: A Taste of the Merton Share 41 Chapter 5: How Much to Invest in the Stock Market? 49 Chapter 6: The Mechanics of Choice 67 Chapter 7: Criticisms of Expected Utility Decision-making 103 Chapter 8: Reminiscences of a Hedge Fund Operator 117 Section II: Lifetime Spending and Investing 127 Chapter 9: Spending and Investing in Retirement 129 Chapter 11: Spending Like You Won't Live Forever 165 Section III: Where the Rubber Meets The Road 173 Chapter 12: Measuring the Fabric of Felicity 175 Chapter 13: Human Capital 193 Chapter 14: Into the Weeds: Characteristics of Major Asset Classes 201 Chapter 15: No Place to Hide: Investing in a World with No Safe Asset 235 Chapter 16: What About Options? 245 Chapter 17: Tax Matters 265 Chapter 18: Risk Versus Uncertainty 275 Section IV: Puzzles 285 Chapter 19: How Can a Great Lottery Be a Bad Bet? 287 Chapter 20: The Equity Risk Premium Puzzle 291 Chapter 21: The Perpetuity Paradox and Negative Interest Rates 297 Chapter 22: When Less Is More 303 Chapter 23: The Costanza Trade 309 Chapter 24: Conclusion: U and Your Wealth 319 Bonus Chapter: Liar's Poker and Learning to Bet Smart 327 Cheat Sheet 335 A Few Rules of Thumb 340 Endnotes 343 Suggested Reading 357 References 359 Index 373

Und dann auf "Zum Home-Bildschirm [+]".

Und dann auf "Zum Home-Bildschirm [+]".